In a world where your smartphone is your go-to for everything from ordering food to tracking fitness, it’s no surprise that car insurance has gone mobile too. Enter the car insurance app—a game-changing tool that lets you manage policies, file claims, and even request roadside help, all from your pocket. With over 6.5 billion smartphone users globally in 2025, these apps are booming.

Why? They’re fast, convenient, and tailored to our digital-first lives. Recent stats show 40% of insurance research now happens on mobile devices. Whether you’re a busy parent or a road-trip enthusiast, a car insurance app can simplify your life. Let’s dive into why these apps matter, how they work, and what’s next for this tech in 2025 and beyond.

Why Car Insurance Apps Are a Must-Have Today

Gone are the days of flipping through paper policies or waiting on hold with an agent. A car insurance app brings everything to your fingertips. The rise of mobile technology has shifted how we handle everyday tasks, and insurance is no exception. People want instant access—whether it’s checking coverage at a stoplight or filing a claim after a fender bender. These apps meet that demand head-on. They’re not just trendy; they’re practical. With features like real-time updates and digital ID cards, a car insurance app saves time and cuts stress. Plus, as cars get smarter and more connected, these apps are evolving to keep pace.

Top Benefits of Using a Car Insurance App

Manage Your Policy with Ease

Picture this: You need to update your address or add a new driver to your policy. Without a car insurance app, that might mean a long phone call or a trip to an office. Now? It’s a few taps on your phone. These apps let you view your coverage, make changes, or renew your plan anytime, anywhere. No more digging through emails or waiting for business hours. Industry surveys show this convenience is a top reason drivers are switching to mobile solutions. A car insurance app puts you in control, making policy management as simple as checking your weather app.

File Claims Faster Than Ever

Accidents happen. When they do, a car insurance app can turn a headache into a breeze. Many apps let you file a claim right from the scene—just snap photos of the damage, upload documents, and hit submit. You can track every step, from submission to approval, without picking up the phone. Some even use AI to assess minor damages instantly, giving you a repair estimate in minutes. Speed matters after a crash, and these apps deliver. Faster claims mean quicker repairs and less downtime—something every driver appreciates.

Unlock Advanced Features

A car insurance app isn’t just a digital filing cabinet; it’s packed with extras. Need a tow? Request roadside assistance with one tap and track help in real-time. Curious about cheaper rates? Telematics features monitor your driving habits—like speed and braking—and can score you discounts for safe habits. Plus, AI chatbots are popping up to answer questions 24/7, from billing to coverage details. These perks make a car insurance app more than a tool—they make it a partner on the road.

How to Pick and Use the Perfect Car Insurance App

Step 1: Find the Right Fit

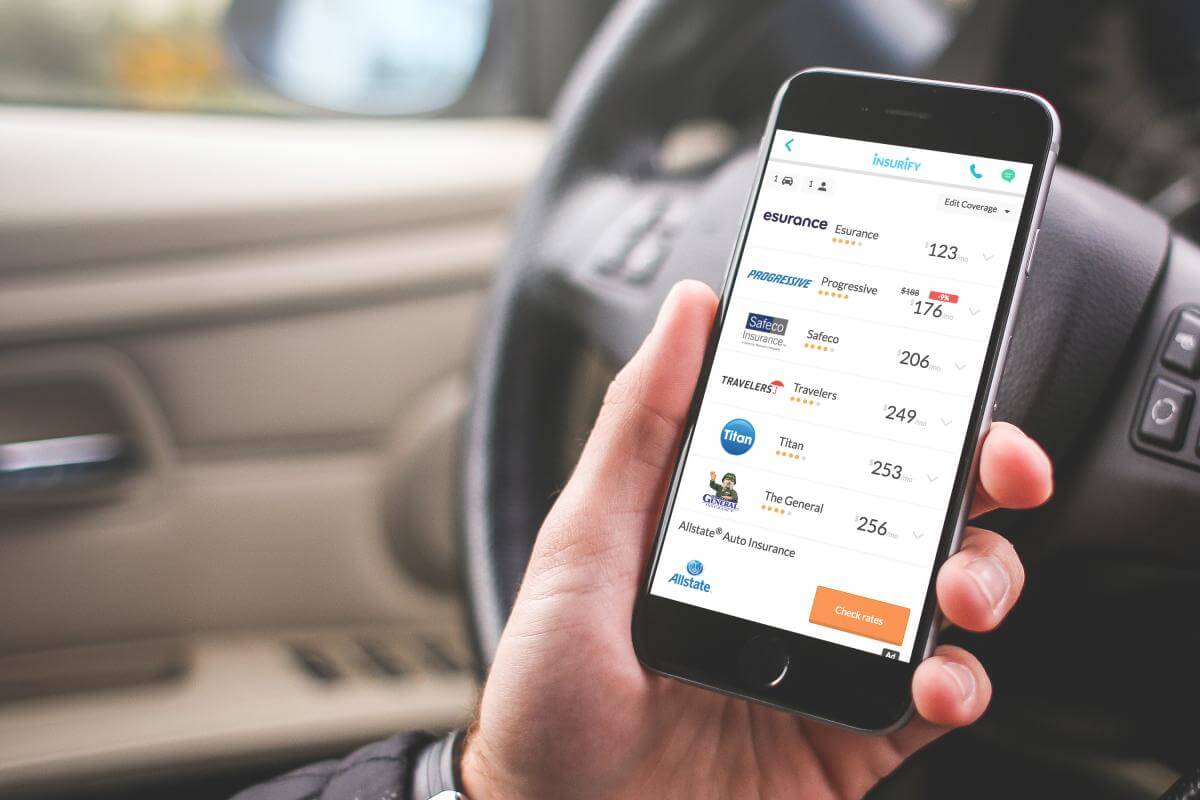

Not all car insurance apps are created equal. Start by checking reviews on app stores—real users will tell you what’s great (or not). Look for must-haves like policy management, claims filing, and secure logins. Big names like GEICO or Progressive often lead the pack, but smaller insurers might surprise you with tailored features. Think about your needs: frequent travelers might prioritize roadside help, while budget-conscious drivers might want telematics for savings. Test a few options—most are free to download—and see which car insurance app feels right for you.

Step 2: Know the Key Features to Look For

A great car insurance app should be easy to use and packed with value. Here’s what to check:

-

User-Friendly Design: Can you find what you need fast, even in a rush?

-

Digital ID Cards: Accepted nationwide, these save you from carrying paper.

-

Secure Payments: Pay premiums safely from your phone.

-

Notifications: Get alerts for renewals or claim updates.

Extras like repair shop locators or driving tips are bonuses. The best apps make complex tasks simple, so you’re never left guessing.

Step 3: Connect It to Your Life

The real magic of a car insurance app comes from how it syncs with other services. Many now link to telematics devices—small gadgets or phone sensors that track your driving. Safe habits could slash your rates. Some apps team up with car makers (think Toyota or Ford) to streamline repairs or offer perks. Others connect to repair networks, letting you book a fix without the hassle. These integrations turn a car insurance app into a hub for all things driving, not just insurance.

The Future of Car Insurance Apps: What’s Coming in 2025 and Beyond

Technology doesn’t stand still, and neither do car insurance apps. Here’s what’s on the horizon:

Smarter Tech, Smarter Insurance

AI is already speeding up claims, but it’s about to get bigger. Imagine an app that predicts your insurance needs based on your driving patterns—or warns you about risky roads in real-time. Blockchain is another player, promising tamper-proof records for policies and claims. No more disputes; just clear, secure data. The Internet of Things (IoT) ties it all together, with connected cars feeding live info to your car insurance app for hyper-accurate pricing.

Usage-Based Insurance Takes Off

Paying for insurance based on how you drive isn’t new, but it’s growing fast. A car insurance app with telematics can track your mileage, speed, and habits, then adjust your rates. Drive less or safer? Pay less. It’s fair, flexible, and rewards good choices. By 2030, experts predict half of all drivers could be on usage-based plans, making these apps a key to savings.

The Rise of Smart Cars and Apps

As self-driving cars hit the roads, car insurance apps will evolve too. They might cover new risks—like software glitches—or link to your car’s systems for real-time updates. Picture this: Your app pings you about a low tire before you notice, then books a fix. Over the next decade, these apps could become your car’s command center, blending insurance with maintenance and safety.

Why You Should Get a Car Insurance App Today

A car insurance app is more than a trend—it’s a smarter way to handle one of life’s essentials. It saves time with easy policy tweaks, speeds up claims with a few clicks, and packs advanced tools like telematics and roadside help. Whether you’re dodging rush-hour traffic or planning a cross-country trip, these apps keep you covered and connected. And with tech like AI and blockchain on the way, they’re only getting better.

Ready to simplify your insurance? Download a car insurance app today and see the difference. If you’re in the industry, now’s the time to build one—because the future of driving is mobile, and it’s already here.