Tradeuplab has emerged as a go‑to tool for CS enthusiasts hoping to squeeze more value out of their item collections. By acting as a comprehensive cs trade up calculator, it empowers gamers to accurately estimate the output of potential trades. Through smart analysis of current market trends, Tradeuplab gives you visibility into your chances of securing rare skins or high-value upgrades. This post dives into how Tradeuplab can elevate your trade‑up strategy, how the cs trade up calculator works, and how to get the most from your skin assets.

Why Trade‑Up Decisions Matter

Trading up in Counter‑Strike can be nerve‑wracking. With the unpredictability of float values and rarity tiers, you might invest dozens of non‑StatTrak skins only to get a common outcome. When you rely on a tool like Tradeuplab, you reduce guesswork and manage risk. The cs trade up calculator aspect helps you anticipate results with projected float ranges, quality tiers, and market prices. That insight lets you decide if a trade‑up is worth the skin value you’re investing. It’s a smarter way to play rather than relying on luck alone.

How the Tool Works

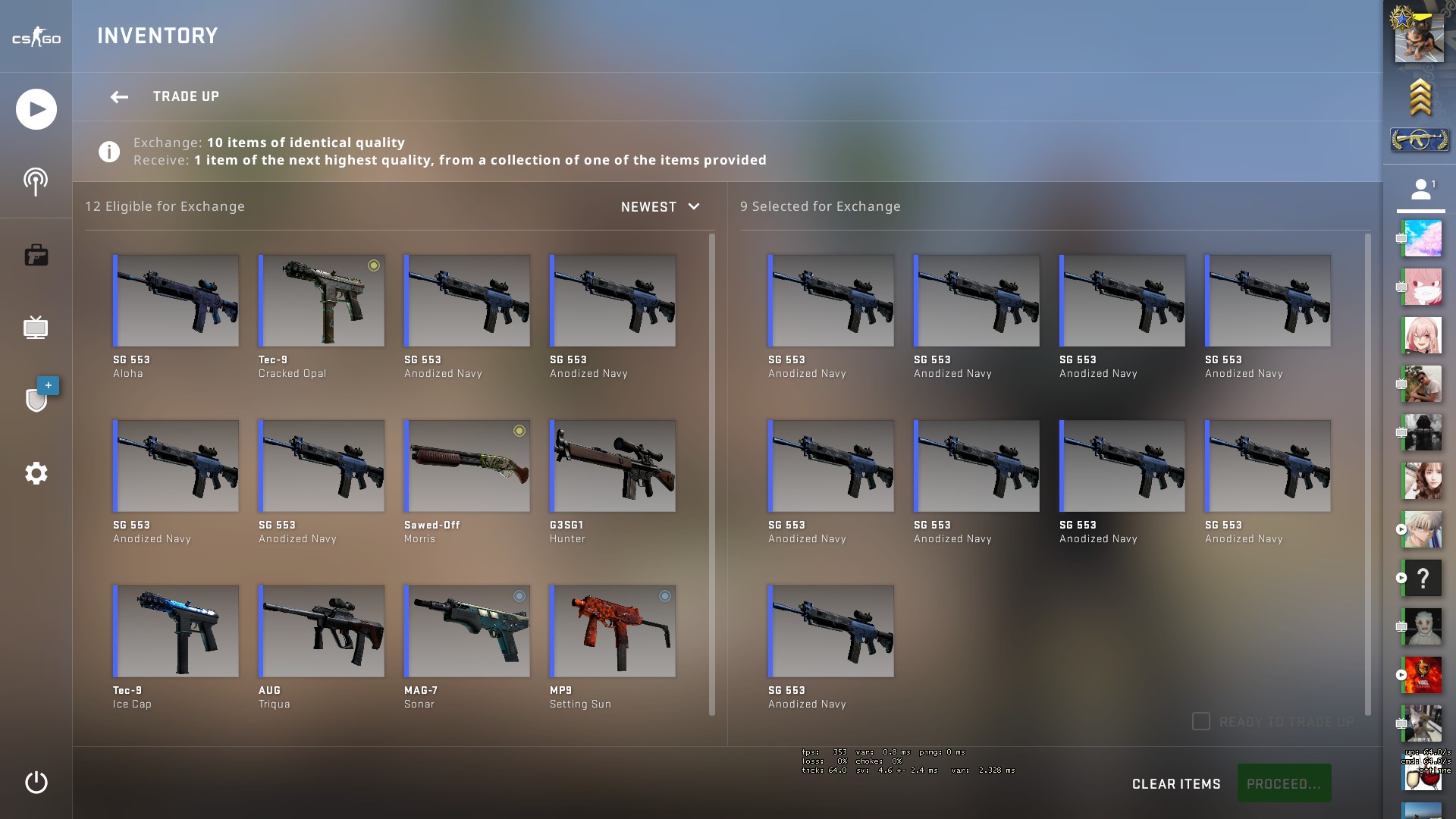

When you access Tradeuplab, you’re greeted with a sleek interface to input your current inventory. For each skin you plan to include, you choose the rarity, pattern index, and float value. The tool then simulates thousands of potential outcomes, calculating statistical probabilities for each case. The end result is a projected output range—showing possible floats, exterior ranges, and expected market values. It even highlights profitable trades once steam marketplace trends are factored in. In short, the cs trade up calculator aspect turns raw numbers into actionable insight.

Setting Realistic Expectations

Even with accurate projections, trade‑ups remain uncertain. Tradeuplab addresses this by clearly showing the probability distribution of output outcomes. You might see that a particular trade offers a 10 % chance of a high‑float StatTrak skin but an 80 % chance of something average. That allows you to adjust plans—maybe take on more trades to chase probability swings, or skip low‑EV options. By quantifying expectations, the tool helps you avoid impulsive trades and stick to a smart, profit‑driven plan.

Evaluating Market Conditions

Prices of skins can fluctuate based on tournaments, game updates, and community trends. A big eleague event might raise demand (and price) for a particular collection. Tradeuplab taps into live marketplace data to evaluate whether an output skin is trending upward or downward. That way, the cs trade up calculator function doesn’t just simulate trade outcomes—it also flags market direction. You’ll know if your potential gain is likely to materialize or if price dips could negate your profit margin.

Optimizing Input Collections

One of the lesser‑known benefits of Tradeuplab is how it suggests optimal input combinations. If you have several skins of the same collection but varying floats, the tool can recommend mixing certain floats to target a narrower output range. That reduces waste and increases efficiency—especially important if you’re aiming for low‑float exteriors. Instead of throwing together random skins, you get a curated input plan designed to maximize success probability.

Identifying Best Collections

Not all collections are created equal. Some trade‑up scenarios have higher expected value (EV) because the rarity distribution, float roll, or market price of the output skin is favorable. Tradeuplab lets you compare across collections to find the best candidates. For example, one collection might offer a solid 5 % chance at a StatTrak knife, while another yields far less. The tool helps you allocate resources wisely and prioritize only the most efficient trade path.

Managing Risk with Bulk Trades

If you plan to run multiple trade‑ups, volatility becomes a major factor. Tradeuplab supports bulk simulation, letting you model dozens or even hundreds of trades at once. That reveals your expected yield and range of potential profit or loss. Rather than relying on one-off luck, you build a portfolio of trades whose average performance aligns with your goals. Especially for high‑volume traders, using the cs trade up calculator this way turns individual swings into predictable returns.

Tracking Past Performance

A smart tool not only projects futures—it logs history. Tradeuplab keeps track of trades you initiate, along with actual outcomes, floats, and resulting market gains or losses. That data helps refine your strategy. If you consistently underperform projected EV, maybe you need to adjust for fees or market timing. If you overperform, perhaps your inventory selection is stronger than average. The tool’s tracking features make it easy to learn and adapt.

Taking Advantage of Pattern Index Insight

Every skin features a pattern index, and some patterns are known for flashy or desirable aesthetics. Tradeuplab integrates pattern index analysis into its projections. If a pattern with particularly vivid colors or rare placements exists within your input skins, the tool can assign a slight bump to projected market value. That nuanced detail redefines the typical tease of trade‑up outcome and leads to smarter trades involving collectible patterns.

Integrating With Bot Trades

Tradeuplab supports integration with external trade bots via simple APIs. This means when your cs trade up calculator scenario shows a high‑EV opportunity, you can automatically execute trades on partnered bots. That workflow eliminates manual delays and minimizes price shifts during execution. Savvy traders enjoy the edge of automated trade‑up, backed by real‑time prediction and rapid execution.

Leveraging Community Curated Strategies

The site features community forums where expert traders share curated step‑by‑step cs trade up calculator strategies. These include which collections are rallying, combining certain float ranges for best results, and examples of high‑profit trade logs. As a user, you benefit from the wisdom of early adopters—and the tool’s modeling capabilities help you evaluate whether a community‑proposed strategy actually holds up under analysis.

Pricing and Subscription Options

Tradeuplab offers both free and premium tiers. The free version supports basic calculator use, allowing you to simulate trades and analyze outcomes. Premium users, however, unlock features such as bulk simulations, live marketplace alerts, advanced pattern analysis, and bot integration. For serious traders, premium features quickly pay for themselves through smarter decision-making. Typical return‑on‑investment is tied to the number of profitable trade‑ups you execute monthly.

Staying Updated with Algorithm Changes

Google’s algorithm updates often affect online tools like Tradeuplab—especially around SEO, indexing, and site performance. The team behind Tradeuplab diligently optimizes for mobile performance, clean HTML markup, and structured data, ensuring users find updated calculator features quickly. Their content is optimized around user intent: educating traders on probability, value, and risk management rather than gimmick‑heavy phrasing. That means high‑quality documentation, rapid bug fixes, and steady feature rollout. From a user perspective, the cs trade up calculator experience remains smooth, responsive, and reliable as the tool grows.

Enhancing User Confidence

Beyond raw numbers, Tradeuplab shows transparency. You can review calculation steps, view floating roll formulas, and cross‑verify probabilities—no black‑box claims. That openness boosts trust. When you see precisely how the calculator reached its estimate, you gain confidence before you click “execute”. Especially for high‑value skin traders, that kind of visibility is essential for peace of mind.

Real‑World Use Cases

Consider a trader with ten FN (Factory New) skins worth $20 each. They want to try for a StatTrak minimal wear knife that trades around $400. Without data, that might feel like a gamble. Tradeuplab’s cs trade up calculator projects a 2 % chance per trade, EV of $8–10 after fees, and aggregate risk across ten executions. The trader can see total EV, adjust strategy by adding more inputs, or scale back if the risk doesn’t justify the return—avoiding an unexpected loss and guiding a more disciplined, data-driven approach.

Educating New Users

Newcomers might be overwhelmed by terms like float, pattern index, or exterior grade. Tradeuplab provides simple tooltips, video walkthroughs, and jargon‑free explanations. Instead of searching or guessing, users can learn within the platform while constructing simulations. This seamless, intuitive education helps beginners grasp key concepts, and enjoy early trade‑up success—building trust and loyalty to the tool.

Supporting Mobile Traders

Many Counter‑Strike traders follow prices and trends on mobile devices. Tradeuplab offers a responsive web interface that adapts to smaller screens. Whether you’re reviewing trade‑up opportunities on your phone during a break or executing trades via bot integration, the experience remains consistent. Focused dashboards display critical metrics: estimated output float, EV deviation, market pricing, and trade‑up reasoning—all optimized for quick viewing and action.

Embracing Future Enhancements

Tradeuplab continues to evolve. Upcoming features include AI‑driven pattern recognition, real‑time bidding data integration, and optional portfolio management dashboards. These will make the cs trade up calculator even richer—letting you model trade‑ups across your entire inventory in one go, with personalized recommendations. As skin trading grows in complexity, having a tool that adapts quickly is invaluable.

Community Impact and Sustainability

Tradeuplab isn’t just a calculator—it’s a central hub for the skin trading community. It hosts discussions on market shifts, rare pattern discoveries, and shared experiences. That active community reinforces the tool’s credibility and ensures content relevance. The site also promotes sustainable trading practices by discouraging speculative behavior and highlighting EV‑negative trades. That ethical approach attracts serious traders who want longevity over quick wins.